Most students and practitioners of competition law are aware that Section 4 of the Competition Act, 2002 deals with the abuse of dominant position. Among other things, the direct or indirect imposition of unfair or discriminatory prices (including predatory prices) in the purchase or sale of goods or services by a dominant entity is deemed under Section 4(2)(a) of the Act as abuse by that entity of its position in the market.

Most students and practitioners of competition law are aware that Section 4 of the Competition Act, 2002 deals with the abuse of dominant position. Among other things, the direct or indirect imposition of unfair or discriminatory prices (including predatory prices) in the purchase or sale of goods or services by a dominant entity is deemed under Section 4(2)(a) of the Act as abuse by that entity of its position in the market.

Of the three kinds of pricing referred to in the provision, predatory price is the only one defined in the explanation to the provision. There is no express guidance on what constitutes “discriminatory price” and “unfair price”. Since the Act uses two distinct terms which are capable of being ascribed independent meanings, they must be recognised as two different forms of abuse by a dominant entity, which also have distinct consequences for the victim of the abusive conduct.

Discriminatory pricing results in what the literature broadly calls exclusionary abuse, whereas unfair pricing is understood to lead to exploitative abuse. Between the two, what constitutes “discriminatory pricing” is relatively easier to understand. The interpretation of “unfair price” poses the challenge of subjectivity and calls for safeguards to prevent the imputation of a meaning which was never intended by the legislature.

As stated earlier, the Act does not define “unfair price”. Section 2(z) of the Act states that words and expressions used but not defined in this Act and defined in the Companies Act, 1956 shall have the same meanings respectively assigned to them in the latter statute. Neither the Companies Act nor the Depositories Act, 1996 appears to define “unfair” or “unfair price”. The definitions of “unfair trade practice” in the Consumer Protection Act, 1986 or the erstwhile Monopolies and Restrictive Trade Practices Act, 1969 too do not seem to be of help in understanding the meaning of “unfair” from the perspective of pricing.

This requires us to look for interpretation of provisions in foreign legislations which are in pari materia with the Indian provision. Article 102 of the Treaty on Functioning of the European Union (TFEU) is similar in language to Section 4(2)(a) of the Competition Act. However, in the EU too, the body of case law on exploitative abuse is significantly small compared to judicial guidance on exclusionary abuse. The trend in the EU too perhaps may be attributed to the reluctance of the European Commission to deal with an inherently subjective enquiry such as exploitative abuse.

Dominant players have to adhere to a higher standard of conduct in pricing

Whatever little case law exists appears to interpret “unfair” as “excessive”. The frequently-cited case on unfair or excessive pricing in the EU is the decision of the European Court of Justice in United Brands Company v. Commission of the European Communities (C-27/76 [1978]), where the following test was laid down:

“The questions therefore to be determined are whether the differences between the costs actually incurred and the price actually charged is excessive, and, if the answer to this question is in the affirmative, whether a price has been imposed which is either unfair in itself or when compared to competing products.”

Of the two questions which need to be answered under the test, the first calls for the establishment of the absence of a correlation between the costs actually incurred and the price charged by the seller for a good or service. This would require the antitrust regulator to also assess the fairness of the profit margin earned by the seller. The larger policy implication is that dominant players could be expected to charge fairly, which obligation does not apply to entities which are not dominant. Simply put, since a dominant player, by definition, is one who can act independent of market forces, he is expected to adhere to higher standards of conduct given the potential for abuse and the consequences for consumers and market as a whole.

Can the regulator fix a price?

Having said this, the question that arises with respect to application of the United Brands test is this: is the regulator expected to merely establish the absence of a reasonable correlation between costs and selling price to arrive at a finding of unfair pricing? Or is it expected of the regulator to first arrive at what is fair before commenting on the unfairness of the price? It is one’s opinion that in either approach, the seller cannot be left in the dark as to what is truly fair in order for him to avoid being hauled up a second time for unfair pricing. In other words, although an enquiry on exploitative abuse requires the regulator to perform the role of a price regulator, it could be said that the regulator may also be called upon to set prices. That said, this is not merely an issue of policy, since a regulator who is the creature of a statute cannot exercise powers which have not been vested in him by the statute.

Having said this, the question that arises with respect to application of the United Brands test is this: is the regulator expected to merely establish the absence of a reasonable correlation between costs and selling price to arrive at a finding of unfair pricing? Or is it expected of the regulator to first arrive at what is fair before commenting on the unfairness of the price? It is one’s opinion that in either approach, the seller cannot be left in the dark as to what is truly fair in order for him to avoid being hauled up a second time for unfair pricing. In other words, although an enquiry on exploitative abuse requires the regulator to perform the role of a price regulator, it could be said that the regulator may also be called upon to set prices. That said, this is not merely an issue of policy, since a regulator who is the creature of a statute cannot exercise powers which have not been vested in him by the statute.

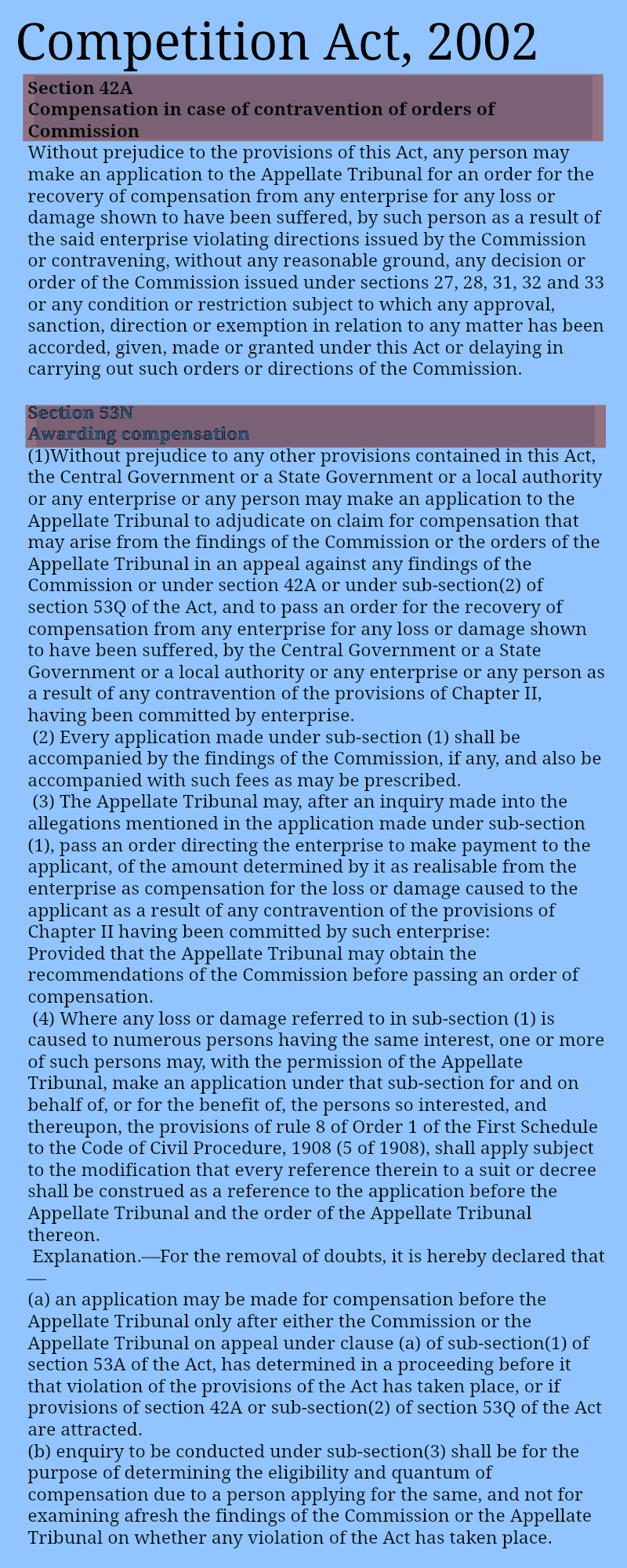

In the Indian context, this boils down to a simple question: whether the Competition Commission has the power to set or fix prices, and not just comment on its unfairness? To answer this, one must interpret Sections 27 and 28 of the Competition Act which spell out the powers of the Commission to deal with abuse of dominant position. Specifically, Section 27(d) empowers the Commission to direct that agreements which are in contravention of Section 4 “shall stand modified to the extent and in the manner as may be specified in the order by the Commission”. Section 27(g) is even broader since it permits the Commission to pass such orders or issue such directions it may deem fit. Similarly, Section 28(2)(a) empowers the Commission to vest property rights, which implicitly includes creation of interest in favour of third parties by way of a license. The combined interpretation of these provisions makes it abundantly clear that the Commission has the necessary power to fix prices in a given case if the case so warrants.

For instance, in a situation where the agreement relates to a patent license between a patentee who is a dominant entity and another entity which is the licensee, the royalty tariff demanded by the dominant patentee could be accused of abuse under Section 4 for unfair or excessive pricing. In exercise of its power under Sections 27(d),(g) and 28(2)(a) based on the language of the provisions, it appears possible for the Commission to modify and spell out the prospective royalty tariff. Simply stated, apart from finding the extant royalty tariff unfair, the Commission has the express power to dictate the future tariff.

This conclusion typically raises objections relating to the ability and expertise of the Commission to set future commercial terms in highly specialised agreements where domain or sectoral expertise is called for to understand the commercial practicalities of the sector. But that objection is not one of statutory power, it is one of the Commission having the wherewithal or expertise to do justice to the nature of enquiry. Therefore, such an objection cannot be used to argue that the Commission lacks statutory authority to fix prices since it is the language of the Act that is decisive of the issue. In any event, this is not an insurmountable challenge since the Commission has the power to consult experts in the relevant domain before it fixes future tariff in specialised contexts.

In conclusion therefore, the Competition Commission has the power to enquire into exploitative abuse by a dominant entity and also has broad powers to fix prices, where warranted.

J. Sai Deepak, an engineer-turned-litigator, is a Senior Associate in the litigation team of Saikrishna & Associates. He is @jsaideepak on Twitter and the founder of “The Demanding Mistress” blawg. All opinions expressed here are academic and personal.