Common funding options available to companies include taking loans from banks, commercial borrowings, and issuing equity shares and convertible instruments. Even though the cost of borrowing is perceived to be lower than the cost of equity, companies often prefer not to take loans because among other reasons, loans require security, increase the repayment obligation on the company, and increase its debt-equity ratio.

Common funding options available to companies include taking loans from banks, commercial borrowings, and issuing equity shares and convertible instruments. Even though the cost of borrowing is perceived to be lower than the cost of equity, companies often prefer not to take loans because among other reasons, loans require security, increase the repayment obligation on the company, and increase its debt-equity ratio.

Another option is to raise equity investment from a closed group of private persons directly. Well known examples of this category of investors, known as ‘private equity funds’ or ‘private equity firms’, include Blackstone, Goldman Sachs, Warburg Pincus, and Carlyle and their investments are called private equity (“PE”) investments. Their objective is to transfer back their shares in the company at a pre-determined rate at the end of a certain investment period and earn a return on these investments. In India, unless the gestation period of the target company’s business is long, this period ranges between three and five years.

In India, private equity investments are mostly made into private or public non-listed companies. While there is no bar, legally or conceptually, to making private equity investments in listed companies, the law governing the acquisition of shares in listed companies above a certain threshold makes them cumbersome.

Since it is aimed at maximising shareholder return in a fixed period, private equity helps in speeding up the process of achieving growth targets. Private equity can also help professionalise some mature companies that earn profits but do not have systems in place with respect to reporting, compliance, and accounting. It can also change the direction of a company and enable it to take calculated risks as opposed to the following the directions of one person. Remember also, that the private equity market is less transparent compared to the market for listed stocks and bonds, and so may offer more opportunities and higher returns.

Strategies

Even though most PE funds are generalists and invest into all kinds of promising ventures in a variety of sectors, specialised PE funds focusing on particular sectors or a particular strategy of investment, have emerged. Private equity investments can be used for financing start-ups, injecting working capital into a growing company, or acquiring a mature company. It can also be used to strengthen a company’s balance sheet.

– Among all categories of PE investments, venture capital, which is provided to start-ups and early stage growth companies, has the highest risk and the highest potential for returns. The strategy here is to invest in companies that promise a bright future. Their business model typically involves high technology industries such as information technology, healthcare, and green or renewable energy. Companies, if successful, experience higher levels of growth.

– Growth capital is provided to mature companies that have already made it through the early stages and are able to generate constant revenues. Such financing is usually for a major expansion or diversification that the company cannot fund on its own. Recently, on 1 May 2015, Goldman Sachs and Rocket Internet invested USD 100 million into food delivery portal ‘Foodpanda’. The investment is aimed at further expanding Foodpanda’s own delivery activities and improving overall customer experience across global markets.

– The strategy behind buyouts is to acquire a stake in a mature, established company with a strong market position in order to exercise influence on it. Privatising a company allows the management to take decisions or adopt strategies that could otherwise be difficult or controversial in a publicly listed company. For example, disposing off an undertaking or a substantial asset of a listed company may be a cumbersome task since the same requires a special resolution to be passed under company law. It is much simpler to pass such resolution after acquiring a stake in a company through which the investor can influence the decisions of the company.

Concerns

While a private equity investment may appear more appealing than a bank loan, there are risks involved in the transaction.

– The PE investor, even when holding a minority stake, exercises influence over the company and restricts the entrepreners discretion to a large extent.

– The costs of continuous and detailed reporting may be an added burden on the target company.

– There are likely to be restrictions on the transfer of shares of the current shareholders of the company for the benefit of the PE investor;

– The rights of the PE investor at the time of its exit from the company along with its return may often be unduly harsh on the promoters. For example, it may require the promoter to compulsorily sell his shares on terms and conditions agreed upon by the PE investor with a third party purchaser.

– Being pure investors, the interest of a PE investor in the company is limited to the recoupment of their investment.

These concerns, especially the risk of diluted control over the company, may often outweigh the benefits of PE investment.

Preparations

To ensure a successful PE investment, lawyers advising the parties have to ensure that both investor and the target are well prepared.

– The target company should weigh the limitations that are likely to be placed on the discretionary powers of its current owners against the need for money from the investors. Clients that are not from a professional background must be clearly advised about these consequences.

– The main concern of a PE investor is to ensure that it exits the company smoothly and with an acceptable return on its investment. An estimate of this return helps avoid disputes later. The target company should prepare this estimate professionally. This requires clarity on the current business situation as well as the forecast.

– A PE investor, prior to investing in the company, always conducts a penetrating due diligence on the target company. The investor will examine every aspect of the company including its governance, compliance, and reporting structures. By ensuring that it is compliant, for example, that meetings are held in time, that books and registers are well maintained, that all filings are made, that proper contracts have been entered into for all activities, and that licenses and registrations have been duly obtained and maintained, the target company can remove uncertainty and delays in the conclusion of a transaction. In fact, the target company should even conduct an internal compliance due diligence on a regular basis.

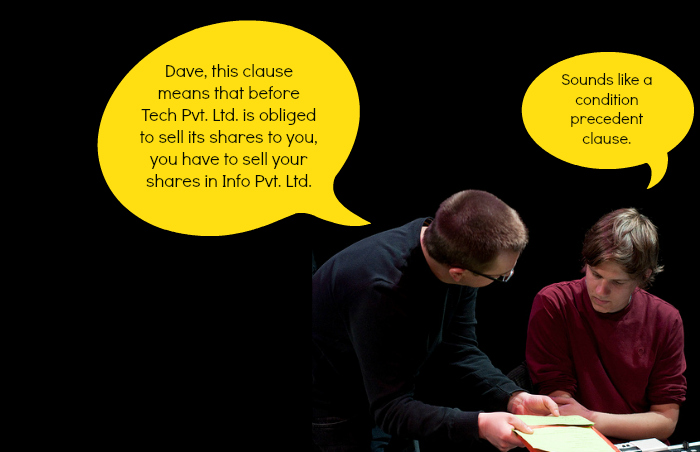

– Disagreement during the finalisation of transaction documents can be largely reduced if, before entering into a transaction, the framework of the investment is set out in a term sheet. There should therefore be clarity on issues such as the nature and type of instrument (whether a convertible or plain vanilla equity), the structure through which equity will be infused, the exit rights of the investor, restrictions on the transfer of shares of the current shareholders, and the governance of the company. The agreement on these issues can be revised after the reviewing the results of the due diligence.

I will reflect about private equity transactions in greater detail in a few more posts here.

Angira Singhvi is a principal associate with Khaitan Sud and Partners and handles general corporate, joint ventures and private equity investments.