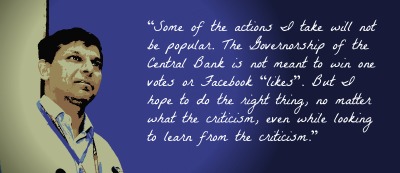

Four days ago, Raghuram Rajan delivered his first speech as the twenty-third Governor of the Reserve Bank of India (“RBI”). Here are some key points from the dramatic speech:

Four days ago, Raghuram Rajan delivered his first speech as the twenty-third Governor of the Reserve Bank of India (“RBI”). Here are some key points from the dramatic speech:

Monetary policy

The first monetary policy of Mr. Rajan’s term can be expected on September 20.

The Deputy Governor Urjit Patel will form a panel featuring RBI staff and other experts to come up, within three months, with suggestions on steps to strengthen the monetary policy framework.

Inclusive development

New branches without prior RBI approval for domestic scheduled commercial banks across India – Banks will still be required to fulfil certain inclusion criteria in underserved areas in proportion to their expansion in urban areas. The RBI will also restrain improperly managed banks from expanding until they convince the RBI of their stability.

New bank licenses – A committee, formed outside the RBI and chaired by Dr. Bimal Jalan, will screen license applicants. The RBI will also explore other ways making entry easier and the licensing process more frequent.

Foreign banks – The regulatory and supervisory control over the local operations of foreign banks will be increased. The RBI will encourage qualifying foreign banks to move to a wholly owned subsidiary structure, where they will enjoy near national treatment on a reciprocal basis.

Foreign banks – The regulatory and supervisory control over the local operations of foreign banks will be increased. The RBI will encourage qualifying foreign banks to move to a wholly owned subsidiary structure, where they will enjoy near national treatment on a reciprocal basis.

Infusing credit – In order to ensure the flow of credit to the productive sectors of the economy, the RBI plans to limit the requirement for banks to invest in government securities to what is strictly needed from a prudential perspective.

Financial markets

The RBI plans to cooperate with the government and SEBI to liberalise the financial markets and remove restrictions on trading in financial instruments.

The RBI will take steps to provide exporters and importers with greater flexibility in their risk management, such as:

(1) enhance the limit available to exporters to re-book cancelled forward exchange contracts to the extent of fifty per cent of the value of cancelled contracts;

(2) allow a similar facility to importers to the extent of twenty-five per cent; and

(3) to develop the money and government securities markets, introduce cash settled, ten-year-interest-rate future contracts and examine the introduction of interest rate futures on overnight interest rates.

Rupee internationalisation and capital inflows

The intent is to push for more settlement in rupees.

The RBI has been receiving requests from banks to consider a special concessional window for swapping Foreign Currency Non-Resident (“FCNR”) deposits. The RBI will offer such a window to the banks.

The current overseas borrowing limit of fifty per cent of the unimpaired Tier I capital will be raised to hundred per cent and the borrowings mobilised under this provision can be swapped with the RBI at the option of the bank at a concessional rate. These schemes will be open up to November 30, 2013.

Financial infrastructure

Retail credit – The RBI will promote the use of “Aadhaar”, the unique ID, in building individual credit histories.

Small and medium enterprises – The RBI will facilitate Electronic Bill Factoring Exchanges, whereby bills from Micro, Small, and Medium Enterprises (“MSMEs”) against large companies can be accepted electronically and auctioned so that MSMEs are paid promptly.

Recovery – The RBI will focus on accelerating the working of Debt Recovery Tribunals and Asset Reconstruction Companies.

Non-performing assets – The RBI proposes to collect credit data and examine large common exposures across banks. This will help the creation of a central repository on large credits, which will be shared with banks.

Households

Together with the government, the RBI will issue Inflation Indexed Savings Certificates linked to the CPI New Index to retail investors by the end of November 2013.

The RBI will implement a national giro-based Indian Bill Payment System, such that households will be able to use bank accounts to pay school fees utilities, medical bills, and make person-to-person transfers electronically.

The RBI will facilitate the setting up of “white” point-of-sale devices and mini-ATMs by non-bank entities to cover the country so as to improve access to financial services in rural and remote areas.

The RBI will set up a Technical Committee to examine the feasibility of using encrypted SMS-based funds transfer using an application that can run on any type of handset. We will also work to get banks and mobile companies to cooperate in rolling out mobile payments.

(Deeksha Singh is part of the faculty on myLaw.net.)