The Insurance Laws (Amendment) Bill, 2008 proposes to increase the foreign direct investment (“FDI”) limit in the insurance sector to 49 per cent from the current limit of 26 per cent. Since there is no clear indication of when Parliament will pass it, we can focus on clearing some ambiguity about the current foreign investment regime.

The Insurance Laws (Amendment) Bill, 2008 proposes to increase the foreign direct investment (“FDI”) limit in the insurance sector to 49 per cent from the current limit of 26 per cent. Since there is no clear indication of when Parliament will pass it, we can focus on clearing some ambiguity about the current foreign investment regime.

The Department of Industrial Policy and Promotion (“DIPP”) in its Consolidated FDI Policy (effective from April 4, 2013) states that 26 per cent FDI is permitted in the insurance sector under the automatic route, provided the companies bringing in FDI obtain the necessary licenses from the Insurance Regulatory and Development Authority (“IRDA”), India’s insurance regulator of India. This means that provided a licence is obtained from the IRDA, there is no need to obtain approval from the Government, the Foreign Investment Promotion Board (“FIPB”), or the DIPP for any foreign investment up to 26 per cent.

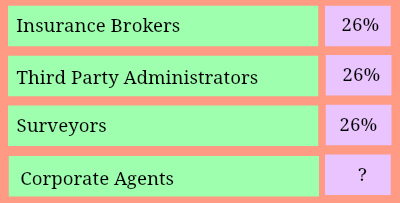

Section 2(7A) of the Insurance Act, 1938 states that the 26 per cent limit applies to insurance companies. What about intermediaries or other players in the insurance sector, such as corporate agents, insurance brokers, third party administrators, and insurance surveyors? The Act does not mention whether such a limit applies to them.

The IRDA has notified rules and regulations in relation each intermediary. The IRDA (Insurance Brokers) Regulations, 2002 (at Regulation 10(2)) and the IRDA (Third Party Administrators-Health Services) Regulations, 2001 (at Regulation 3(6)) clearly specify that foreign investment up to 26 per cent is permitted. A recent amendment to the Insurance Surveyors and Loss Assessors (Licensing, Professional Requirement and Code of Conduct) Regulations, 2000 (regulating insurance surveyors) has also specifically inserted the 26 per cent limit. The position of these intermediaries is therefore clear, both under the FIPB policy and under the IRDA rules and regulations.

There is however, another key category of intermediaries about which the IRDA has not issued any clarifications — corporate agents. Corporate agents are intermediaries in the insurance sector who sell and solicit insurance products. Simply put, an insurer appoints a corporate agent (who is registered with the IRDA) to sell its insurance products to the public. Sale by an unregistered intermediary is prohibited.

Corporate agents are governed by the IRDA (Licensing of Corporate Agents) Regulations, 2002 and the Guidelines on Licensing of Corporate Agents dated July 14, 2005. None of these regulations specify any FDI limit. In absence of any specific reference however, it can be argued that one should refer to the Consolidated FDI Policy since it is the one document that consolidates all instructions regarding FDI in India. If this interpretation is to be taken, corporate agents, being a part of the insurance sector will automatically be subject to the 26 per cent FDI cap. However, Berkshire India, a corporate insurance agent, is shown as a majority owned subsidiary of Berkshire Hathaway Inc., a foreign company. This would mean that there is 100 per cent foreign investment in Berkshire India. While news reports suggest that the FIPB is concerned about 100 per cent foreign investment in corporate agents, there is no clear circular or regulation issued by the IRDA in this regard.

Corporate agents are governed by the IRDA (Licensing of Corporate Agents) Regulations, 2002 and the Guidelines on Licensing of Corporate Agents dated July 14, 2005. None of these regulations specify any FDI limit. In absence of any specific reference however, it can be argued that one should refer to the Consolidated FDI Policy since it is the one document that consolidates all instructions regarding FDI in India. If this interpretation is to be taken, corporate agents, being a part of the insurance sector will automatically be subject to the 26 per cent FDI cap. However, Berkshire India, a corporate insurance agent, is shown as a majority owned subsidiary of Berkshire Hathaway Inc., a foreign company. This would mean that there is 100 per cent foreign investment in Berkshire India. While news reports suggest that the FIPB is concerned about 100 per cent foreign investment in corporate agents, there is no clear circular or regulation issued by the IRDA in this regard.

In the absence of clarity, it can be argued that the amount of foreign investment permitted depends on the nature of the corporate agency.

Corporate agency is not meant to be the principal business of an entity. This is evident from the Guidelines on Licensing of Corporate Agents dated July 14, 2005, which states at Paragraph 1 that an applicant for corporate agency should normally be a company whose principal business is something other than the distribution of insurance products. Insurance distribution should be a subsidiary activity.

This means that corporate agents are normally entities that carry on other businesses as their principal activity. Commercial banks, for example, carry on banking business as their principal activity and corporate agency as their subsidiary activity. In such a situation, the foreign investment limit should be governed by the amount of foreign investment permitted in the principal activity. So, a bank will be governed by foreign direct investment of the banking sector rather than of the insurance sector. This is because the bank’s principle business is banking.

Some provisions on the other hand, permit stand-alone corporate agents. These are entities that solely carry out corporate agency business. In such a case, the 26 per cent cap should strictly govern these entities, as they are only engaged in the insurance sector.

This means that the amount of FDI in a corporate agent can differ depending upon the nature of the corporate agency business. If corporate agency is the principal activity, the 26 per cent cap will apply. If corporate agency is a subsidiary activity, the rules governing the principal business, will determine the FDI limit.

While there is no formal clarification, either from the FIPB or from the IRDA, given that entities such as commercial banks cannot be subject to two different FDI investment limits, this appears to be a likely explanation.

In any event, formal clarification from the IRDA to clear the air on FDI limits for corporate agents is long overdue.

(Deepa Mookerjee is part of the faculty on myLaw.net.)