“Call options” and “put options” are used frequently in shareholders agreements. As you know very well by now, a shareholders agreement specifies the rights and obligations of shareholders and sets out the manner in which the company will be governed. We have already seen some vital clauses used in these agreements such as condition precedent clauses and restrictions placed on the transfer of shares. Let us now look at “call” and “put” options.

“Call options” and “put options” are used frequently in shareholders agreements. As you know very well by now, a shareholders agreement specifies the rights and obligations of shareholders and sets out the manner in which the company will be governed. We have already seen some vital clauses used in these agreements such as condition precedent clauses and restrictions placed on the transfer of shares. Let us now look at “call” and “put” options.

Simply, a call option is a right but not an obligation to purchase shares at a specified price, on the happening of a specified event. If A and B are two investors in a joint venture company, A may have a call option over twenty-six per cent of the shares held by B, which he can exercise once the limit on foreign direct investment (“FDI”) is raised. This means that once the FDI cap is raised, A has a right to purchase twenty-six per cent of the shares held by B. If A exercises this right, B cannot decline to sell the shares to A.

A put option on the other hand, is a right but not an obligation to sell shares upon the occurrence of a specified event at a specified price. If A has a put option over twenty-six per cent of his own shares in the company that he can exercise once the company is insolvent, it means that if the company declares insolvency, A can sell his shares to B. Once A exercises his put option, B cannot decline to purchase A’s shares.

Junior lawyers should understand these mechanisms well because they can be used in a shareholders agreement in various scenarios. To think that call and put options are only useful in an FDI limit scenario or an insolvency situation (as discussed above), would be incorrect. Let us first go through some scenarios to understand how they may be useful.

Versatile options

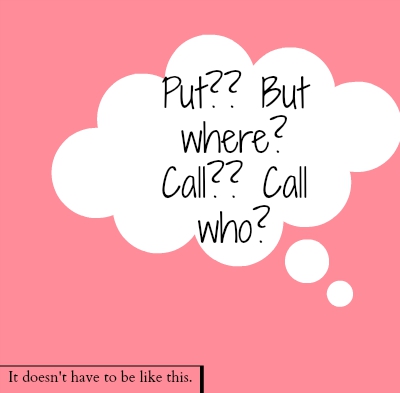

Assume that there are two shareholders in a joint venture company – A and B. You are representing ‘A’. A comes to you with a simple question – what if B commits a material default of the provisions of the shareholders agreement and is unable to cure the defect or default? What are the options available to A?

You can tell A that he can either ask for a mechanism by which he can sell his shares and exit the company (a put option) or a mechanism by which he can insist that B exits (a call option), when the material default occurs. The latter mechanism means he can continue in the company and ask B to exit. If you know these mechanisms well, you can give your client two options – either continue in the company and buy the other party’s shares (by exercising the call option) or sell his shares and exit the company (by exercising the put option).

You can tell A that he can either ask for a mechanism by which he can sell his shares and exit the company (a put option) or a mechanism by which he can insist that B exits (a call option), when the material default occurs. The latter mechanism means he can continue in the company and ask B to exit. If you know these mechanisms well, you can give your client two options – either continue in the company and buy the other party’s shares (by exercising the call option) or sell his shares and exit the company (by exercising the put option).

Take another scenario. Suppose your client would like to continue as a shareholder in the company only if the company generates a certain amount of revenue after a specified period (say five years). If not, your client would like to exit. If you know what a put option is, you can simply suggest that your client include a put option over his own shares.

These two mechanisms can therefore be used throughout shareholders agreements to address different scenarios and the various needs of your client. There are some points that you should keep in mind while drafting them.

1. Be precise about whether your client has a right to sell shares or is under an obligation to purchase shares. Use words such as ‘right’ and ‘obligation’ wisely to ensure that the burden is being placed on the correct party.

2. Specify the amount or percentage of shares that are subject to the call or put option. At the time of enforcement, there should be no confusion on the amount of shares that can be sold or bought.

3. Remember, contractual arrangements can work in many permutations and combinations. For instance, if you are drafting a put option clause, it is not necessary that the shares always need to be sold to the other parties in the shareholder agreement. You can also have a right to sell your shares to a third party of your choice. Similarly, it is up to the parties to decide whether the option should apply to a part of the shares or all the shares that a party holds. As a lawyer, you should advise your client about the most appropriate form of the clause depending upon his or her intentions.

4. As always, the letter of the law plays an important role. For instance, the Reserve Bank of India has made it clear that a non-resident investor should not be guaranteed any assured exit price at the time of making an investment. The exit price must be a fair price calculated according to the prescribed guidelines and at the time of exit. Keep this in mind when you draft a put option for a foreign investor and always know the correct legal position before drafting.

5. Always flesh out the manner in which the clause will work. For instance, if your client has a call option on the shares held by the other party, you should specify the manner in which your client should send a notice to the other party indicating his or her intention to exercise the call option (known as a call option notice), the time period within which the other side must respond (the call option period), the price at which shares will be sold (the call option price), and the maximum time period within which the sale must take place. Specifying these details makes it simpler to execute the sale and implement the clause effectively.

Remember these basic points while drafting. Make sure that you are always clear about what a clause is intended to achieve. Take the time to understand the needs of your client and draft accordingly.

(Deepa Mookerjee is part of the faculty on myLaw.net)