151 years ago, on February 25, 1863, the United States enacted the National Banking Act of 1863 (“National Banking Act”), the first federal banking law, with the goal of creating a single national currency.

151 years ago, on February 25, 1863, the United States enacted the National Banking Act of 1863 (“National Banking Act”), the first federal banking law, with the goal of creating a single national currency.

Single currency, national banks

At that time, notes were issued by several state banks and linked to their gold and silver holdings. Even though these notes were exchangeable and denominated as U.S. dollars, they were being issued by different banks with different paying abilities. This is because the gold and silver holdings of these banks were not uniform and they were not linked to any single unified entity or standard. The established national banks could issue notes that were printed by the government and backed by the U.S. Treasury. After the Act, each bank’s ability to issue notes was linked to the level of capital it deposited with the Comptroller of Currency at the Treasury, a position created under the Act. It also facilitated the phasing out of notes issued by the state banks by providing for a system of taxing those notes.

The banking system

Within one year however, the 1863 law was replaced by the National Bank Act of 1864 (“NBA”), which created the banking system of the United States. It established federally issued bank charters, which enabled the setting up of new national banks, and the conversion of state banks into national banks.

This is not to say that state banks became redundant. Since state banks could no longer issue notes, the capital requirements they had to fulfil became less onerous. This allowed the state banks to carry out rapid branch expansion while they continued to compete with the national banks in relation to regular banking services.

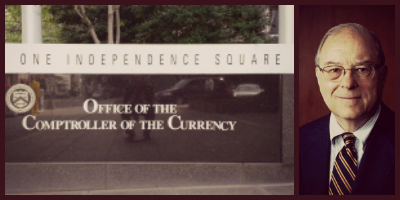

This dual system of banking created by the NBA now defines the U.S. banking system. The Comptroller of Currency (like the Reserve Bank of India in India) is responsible for the administration and supervision of national banks (and some of the activities of their subsidiaries).

As recently as 2004, the provisions of the NBA were used by the then Comptroller to bar the Attorneys General of states from investigating and prosecuting national banks for predatory lending practices in relation to the real estate sector. The Comptroller’s move is believed to have hastened the sub-prime mortgage crisis.

Banking regulation

The NBA created a unique, but fragmented, system of banking regulation in the U.S. with both federal and state-level regulation. Banking regulation is also separated from the regulation of other financial services, each of which is regulated by a separate agency.

Apart from the Comptroller, depending on the charter and the organisational structure of the bank, a national bank’s primary federal regulator could also be the Federal Deposit Insurance Corporation or the Federal Reserve Board.

The varying priorities of banking regulation

The NBA was the first step in defining banking regulation in the U.S. Since then, several laws have addressed different regulatory concerns.

– Following the 1929 depression, the Glass-Steagall Act was enacted to establish the Federal Deposit Insurance Corporation and provide deposit insurance to protect depositors from losing their deposits if a bank became insolvent.

– In 1999, a part of the Glass-Steagall Act was repealed, with the enactment of the Gramm–Leach–Bliley Act also known as the Financial Services Modernization Act of 1999. This allowed commercial banks, investment banks, and securities firms to consolidate. The aim of the Act was to increase competition in and provide equal access to the financial services industry. One of the criticisms of this Act however, was that it would result in banks that would become ‘too big to fail’.

– When the recession hit in 2007, the necessity of overhauling financial regulation in the U.S. became the primary concern of the U.S. government. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) was enacted in response to this need. It impacted not just banking regulation, but every sphere of financial services regulation. It streamlined the regulatory framework for the financial services industry in the U.S. by creating new agencies like the Financial Stability Oversight Council and the Bureau of Consumer Financial Protection. It also substantially changed the powers of existing agencies including the Comptroller, the Federal Reserve, the Federal Deposit Insurance Corporation, and the U.S. Securities and Exchange Commission.

– When the recession hit in 2007, the necessity of overhauling financial regulation in the U.S. became the primary concern of the U.S. government. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) was enacted in response to this need. It impacted not just banking regulation, but every sphere of financial services regulation. It streamlined the regulatory framework for the financial services industry in the U.S. by creating new agencies like the Financial Stability Oversight Council and the Bureau of Consumer Financial Protection. It also substantially changed the powers of existing agencies including the Comptroller, the Federal Reserve, the Federal Deposit Insurance Corporation, and the U.S. Securities and Exchange Commission.

From its formative period therefore, federal banking regulation in the U.S. has switched priorities from the protection of depositors to supporting the aggressive practices of banks, and then back again to the protection of depositors. It is still too early to say whether the lessons from the last recession will continue to affect financial policy and regulation in the U.S.

The Indian parallel to the 1863 law is the Reserve Bank of India Act, 1934. Studying the evolution of banking laws in the United States provides an interesting parallel to the evolution of our own laws. The Indian government and Reserve Bank of India have always been conservative, often taking pointers from the mistakes of regulators in the West. So far, this has held them in good stead.

(Deeksha Singh is part of the faculty on myLaw.net.)